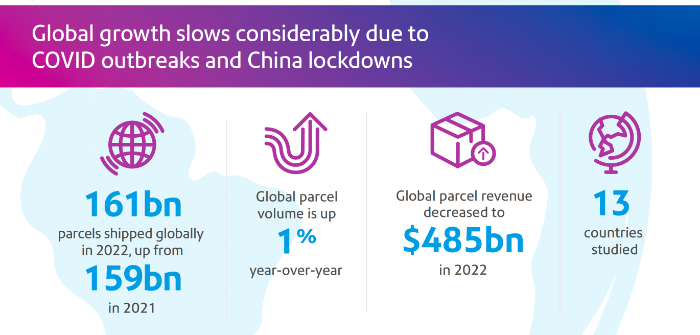

Pitney Bowes has released its 2023 Parcel Shipping Index, which has revealed a 5% year-on-year fall in UK parcel volumes that is the first of its kind since 2013. This Parcel Shipping Index – featuring 2022 data from 13 major countries – also found that coming off two years of pandemic-fuelled growth, global parcel volumes increased only 1% in 2022 compared to 2021, largely due to the lockdowns in China.

The UK shipped, received and returned 5.1 billion parcels in 2022, a 5% decline in volumes from 5.4 billion parcels in 2021, attributed to a drop of 7% in e-commerce sales. Physical stores performed markedly better than online stores, and even Amazon experienced its lowest-ever annual growth rate of 5.2% in the country. This is the first time the UK has experienced a parcel volume drop since 2013.

Pitney Bowes forecasts that UK parcel volume is most likely to reach 5.6 billion by 2028, with a 1% compound annual growth rate (CAGR) from 2023 to 2028. The index also shows 14 million parcels were shipped in the UK each day in 2022, which is around 162 parcels per second. Per capita parcel volume for the UK declined nominally from 80 to 76 with an average of 181 parcels shipped per household during 2022. The UK parcel market is highly consolidated, with the top five carriers (Royal Mail, Hermes, Amazon Logistics, DHL, UPS) accounting for 71% of parcel shipments in the country. In GBP, parcel revenues declined by 2%, from £18.7bn (US$23.8bn) to £18.3bn (US$23.4bn).

Georges Berzgal, chief revenue officer and senior vice president (SVP) of global e-commerce at Pitney Bowes, stated, “A year-on-year drop in deliveries for the first time in a decade is a reminder that the e-commerce industry is not immune to broader economic trends. Customers are tightening their belts amid an ongoing cost-of-living crisis and are therefore placing fewer online orders. With even the major players struggling to sustain revenue in this climate, carriers must ensure they keep up to speed with evolving customer preferences, such as increasing demand for both same-day delivery and services that are environmentally sustainable or short of that click-and-collect. Otherwise, shoppers will have their heads turned by competitors in the market or the alternative of shopping in person.”

The 2023 index found a direct alignment between parcels per person and GDP per capita in the US, Germany, Brazil and India. Parcels in China, Japan and the UK exceed GDP per capita, suggesting a significant share of exports and deep penetration of e-commerce. Norway, Sweden and Australia, meanwhile, saw parcels per person lag behind GDP per capita, suggesting a fairly low penetration of e-commerce.

China parcels grew at the slowest rate in Index history, hitting 110.6 billion parcels in 2022, marking only a 2% growth, due to lockdowns and Covid-19 outbreaks. China’s parcel volume had grown at a CAGR of 23% between 2017 and 2022. Pre-pandemic China parcel volume forecast was 25% CAGR between 2018 and 2022 and actual volume growth was lower, at 22% CAGR between 2018 and 2022.

The report references a ParcelHero study that found that the demand for same-day delivery is on the rise, with 56% of online shoppers now prioritizing it, compared to 33% in 2021.

The Index found that UK parcel volume reached 5.1 billion in 2022, down 5% from 5.4 billion in 2021. Per capita, the UK generated 76 parcels down from 80 parcels in 2021, the second highest, behind only China at 78, with 162 parcels generated every second, equating to around 14 million parcels per day. Around 181 parcels were shipped per household in 2022, down from 192 in 2021.

The report also revealed that more carriers are focusing on zero-emission deliveries, with electric vehicle (EV) fleets growing in the UK. In January 2023, Royal Mail deployed its 4,000th EV van from its Blackpool office as part of its goal to become net zero by 2024, and plans to operate all delivery and collections in the area using electric vehicles. Investments in smart parcel lockers are expected to make the UK one of the largest parcel locker networks in Europe.

By revenue, all major carriers except Amazon Logistics reported a decline when measured in USD. Royal Mail generated the highest revenue of all major carriers at US$5.1bn, a decline of 26% from 2021. Amazon Logistics is the only carrier that had a parcel revenue increase in 2022, at 7% higher than in 2021. Amazon Logistics generated the highest CAGR in revenue growth between 2016 and 2022 with 28%, followed by Hermes (27%).

Royal Mail shipped 1.3 billion parcels, a 19% decline from 1.6 billion in 2021; UPS’s volume declined by 15%. DHL, Hermes and Yodel had single digit increases in parcel volumes; UK Mail (DHL) increased parcel volume by 17%. While Amazon Logistics experienced an increase in parcel revenue, its volume declined by 5% decline in parcel volume from 0.92 billion in 2021 to 0.87 billion in 2022.

Over the last seven years, Amazon Logistics generated the biggest increase in market share by revenue at 9% CAGR between 2016 and 2022, followed by Hermes at 8% and DPD at 3.%. Royal Mail declined in revenue share by 9% CAGR between 2016 and 2022. In 2022, market share by revenue remained roughly the same for UPS, Hermes, DPD, DHL and UK Mail (DHL), while Amazon increased from 12% share to 15% and Royal Mail lost 4%, from 27% share in 2021 to 23% share in 2022. Amazon Logistics generated the biggest increase in market share by volume at 11% CAGR between 2016 and 2022, followed by Hermes at 5%, DHL at 2%, and DPD at 2%. Royal Mail experienced a 14% decline in volume share CAGR between 2016 and 2022, the highest drop among carriers.

Globally the Parcel Shipping Index found that parcel volume reached 161 billion in 2022, up 1% from 159 billion in 2021; 5,102 parcels shipped per second compared to 5052 in 2021. Parcel revenue in USD was US$485bn, down 1% from US$489bn in 2021, impacted by the strong USD and its increase in value compared to other currencies in the Index. The highest CAGR between 2017 and 2022 for parcel volume was generated by China at 23% followed by Brazil at 20%. The highest CAGR between 2017 and 2022 for parcel revenue was generated by China at 17% followed by the US at 13% and by Italy at 12%. China remains the largest parcel volume market, contributing to the slow volume growth in 2022 due to its unprecedented low 2% parcel volume increase. The USA remained the market with the highest carrier revenue, reaching US$198bn, an increase of 7% year-over-year.

To keep up with the latest Pitney Bowes developments, click here.